Options pools help prop up liquidity in new tokens.Investor token holdings may be partially or fully back positions to reduce the use of leverage.Users will be able to create their own customized options and vaults.Though most platforms are offering up basic options contracts, options product innovation is expected to surpass that of traditional options markets. More potential combinations of spreads and options.Gas costs can be spread across all users in a pool.Options, typically an inexpensive way of providing portfolio diversification, are becoming even cheaper.Generally higher-yielding, sellers of DeFi options can enjoy the currently high premiums.Crypto options minted on the DeFi platforms on the blockchain provide many added benefits: The primary benefit of options is that hedgers and investors can reduce risk or go long or short at a much lower cost. We expect this to be the calm before the storm of innovation that will lead to high growth in the coming years.ĭue to the ease of use of DeFi options structuring and minting, users will increasingly be structuring their own products with a few clicks and even launching their own vault pools to promote to others. In 2021, the total value locked in options protocols rose from $85M to $1B. Options are a handy risk management tool in volatile markets like commodities and cryptocurrency. Structured derivatives products are a center of innovation in financial products. If you invest in $WBTC and the payout is in $WBTC, it is said to be physically settled (in the actual underlying asset). In DeFi options markets, payout in the platform’s token would be considered cash settlement. More practically, investors invest in commodities in exchange for cash settlements. If you buy lean hogs for physical settlement in traditional markets, they could be dumped on your front lawn. Options can be cash-settled or physically settled. The investor deposits assets to the vault’s smart contract to execute the strategy.Įither way, you will pay a premium to enter into the options contract, and if you do not exercise the option right, you only lose the premium fee. Each vault offers a different options strategy (e.g., covered call in $ETH, put on $WBTC) executed by a smart contract and backed by a pool. Options vaults are similar to copy portfolios on investment platforms. On DeFi options platforms, investing in options is as easy as investing in a liquidity farming pool. The composability and interoperability of DeFi is taking structured options product innovation to a new level and improving the investor risk-reward profile. DOVs make it easy for even retail traders to enter the market by depositing their crypto coins into the vault option strategy of their choice, not unlike choosing your favorite ETF or copy trading portfolio.Ĭurrently, DeFi options range from covered puts and covered calls on popular crypto pairs to user-created vaults for highly customized risk coverage. They increasingly do so through DeFi option vaults (DOV) on platforms like Ribbon and Friktion. Investors who are bullish, bearish, and love volatility can easily invest in DeFi options through decentralized options platforms. Or they can let the option expire and only lose the options fee.ĭecentralized finance is now making options more accessible to the average investor. With options, investors can profit whether prices rise by buying the right to buy the asset with call options, or fall by purchasing the right to sell the asset with put options at a predetermined price and date. Large institutional investors will not enter the cryptocurrency market in a meaningful way without access to this essential risk management tool.

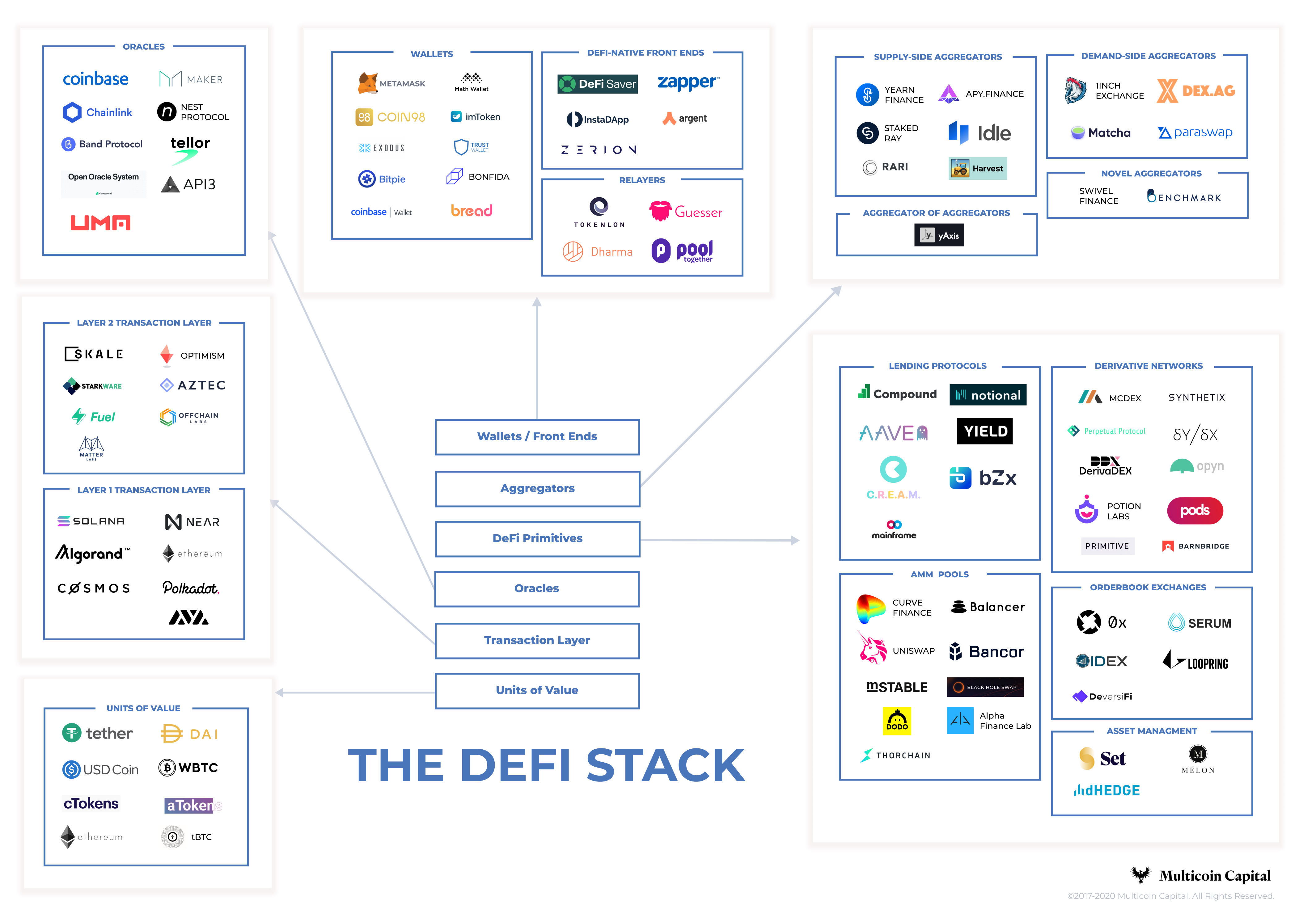

#Defi overview full

For a small options fee (premium), investors can place long (buy) or short (sell) directional bets on crypto assets without putting out the full cost of the position.

Over the last year, investor interest has been peaked by a surge in DeFi platforms selling a new financial instrument called a DeFi option.

0 kommentar(er)

0 kommentar(er)